Looking for a clear guide on how to promote mobile banking?

You’re not alone. Those still relying on traditional promotion channels are overspending, while banks using smart push notification strategies are cutting acquisition costs by up to 70%.

If you’re a…

- Banking executive seeking cost-effective digital acquisition strategies

- Or, a marketer struggling with high mobile app promotion costs

- Or, a digital transformation leader comparing engagement solutions

Think about it: when was the last time your paid ads delivered a sub-$1 acquisition cost? Or your email campaigns hit 40% engagement?

The reality is, most banks are looking at how to promote mobile banking backwards. Our 2025 data shows traditional methods now cost an average of $35-50 per acquired mobile banking user.

In this guide, I’ll share exactly how leading banks are using push notifications to promote their mobile apps, backed by real performance data from our platform.

Send Mobile App Push Notifications Today!

Push notifications are a super effective, low-cost marketing tool to help you grow your repeat traffic, engagement, and sales on autopilot.

Why Most Banks Waste Money Figuring Out How to Promote Mobile Banking

I see it every day at PushEngage: banks pouring thousands into mobile app promotions, yet struggling with user acquisition. The painful truth? You’re probably wasting up to 70% of your promotion budget on outdated strategies.

Let’s address the elephant in the room – traditional ideas on how to promote mobile banking aren’t working anymore:

- Paid social ads: $45.20 per acquisition

- Google Ads: $38.60 per acquisition

- Email campaigns: 12% open rates

- Billboard & print: Unmeasurable impact

What’s really happening? Banks are:

- Targeting too broadly on social media

- Competing for expensive banking keywords

- Relying on declining email engagement

- Missing crucial engagement touchpoints

Here’s what successful banks using PushEngage achieve instead:

- $0.42 average cost per acquired user

- 42% engagement rates

- 89% long-term retention

- Automated user activation

The difference isn’t just in the channels – it’s in the approach. While most banks focus on driving app downloads, leading banks build automated engagement funnels that:

- Convert website visitors to app users

- Activate features systematically

- Re-engage dormant users automatically

- Scale personally with each user

Want to know exactly how they do it? Let’s dive into the proven strategies that actually work in 2025.

3 Proven Ways to Promote Mobile Banking

I’ve already spoken on how the entire approach on how to promote mobile banking is wrong across the industry. But what’s the right mindset? What’s the right approach? Let’s check out some practical methods.

1. Push Notification Campaigns That Convert

I recently watched a bank transform their 0.5% mobile app activation rate to 42% in 30 days using PushEngage. The difference? They stopped treating push notifications as another blast channel and started delivering value at exactly the right moment.

Turn Every Banking Moment into an Engagement Opportunity

You can use smart trigger systems to add real value to your customers through your app and website. Think of it in this way: you can act as a personal banker to one, maybe ten of your top clients. But what if you can scale that using the right technology?

Everyone wants a personal banker. But not everyone qualifies for that level of support, right? Well, what if you could set up personalized messaging so that you could do that at scale? What if you could use your app to make a real difference in the Average Joe’s life?

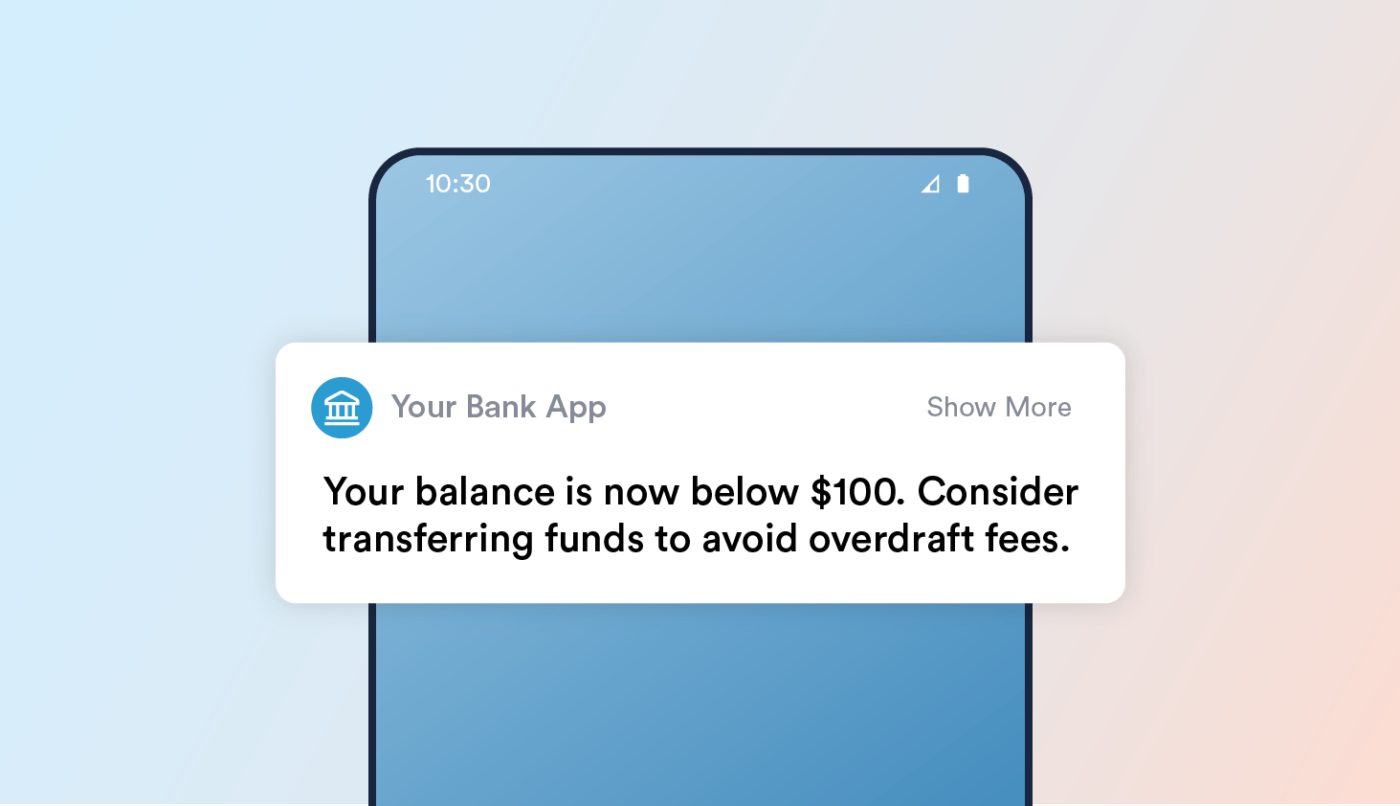

- Transaction completion → Instant spending insights: Help users track expenses in real-time

- Paycheck deposit → Investment recommendations: Guide financial decisions when users have funds

- Bill due date + Low balance → Early warning + Quick transfer option: Prevent overdraft fees before they happen

You came here asking how to promote mobile banking? There’s your answer: Add so much value to mobile banking that your customers feel stupid saying no to it.

Keep Track of the Behavioral Journey

You can create personalized paths that drive feature adoption:

- First login → Guide to mobile deposit using an automated welcome campaign → $5 reward for first deposit

- Card activation → Secure payment setup → Cashback activation

- Investment account view → Market update → One-tap portfolio rebalancing

Isn’t it fascinating how easy it is to look at customer data, understand their behavior, and act on it? With PushEngage, you’ll most definitely be able to act on customer behavior.

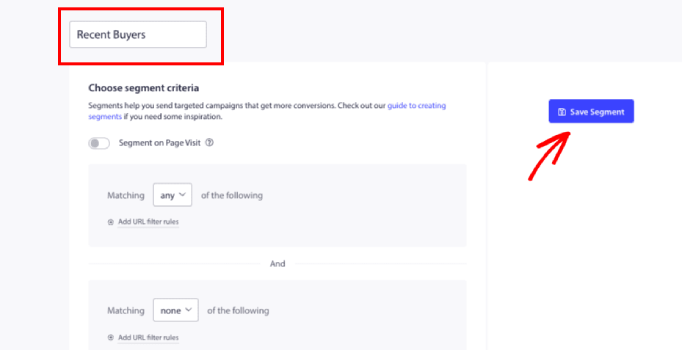

Use Intelligent Segmentation to Send the Right Messages at Scale

Creating segments and audience groups is one of the most powerful ways to scale personalized banking. If you’re still wondering how to promote mobile banking, here are a few ideas you can use to get more customers to sign up:

- Geographic zone segmentation → Multi-language notifications + Local branch updates

- Account type segmentation → Premium service alerts + Tailored product offers

- Usage patterns → Feature education for underutilized services

- Risk profiles → Personalized security recommendations

What’s stopping you? With PushEngage, you’ll need to set up these segments and audience groups once when installing app and web push notifications. After that, your marketing team can use a simple dashboard to create campaigns that convert.

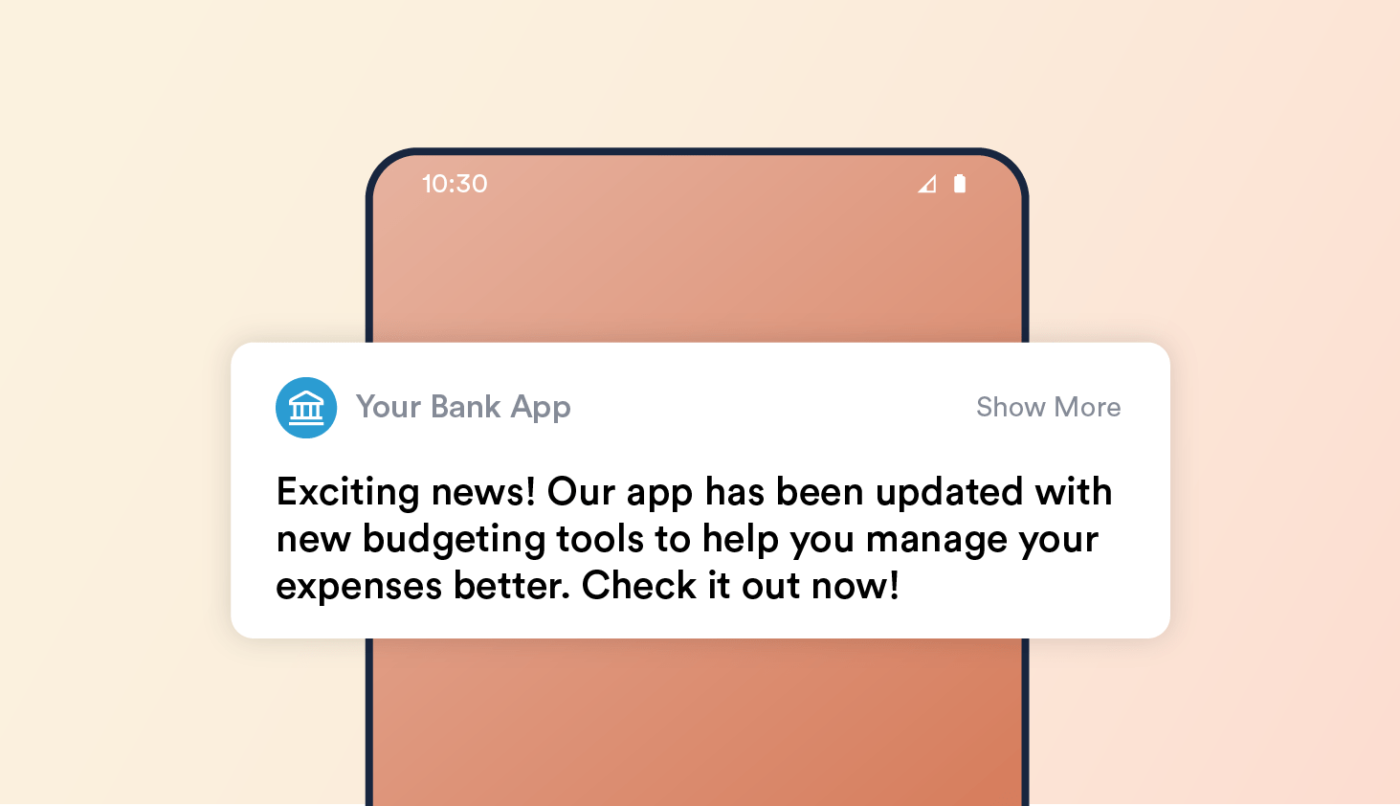

Build a Dynamic Content Engine

Using a tool like PushEngage, you don’t just notify. You empower your users. Using dynamic tags, you can send notifications about:

- Real-time balance updates → Instant fraud prevention

- Spending pattern analysis → Proactive budgeting advice

- Branch wait times → Save customers’ time with optimal visit scheduling

- Personal loan eligibility → Pre-approved offers when most relevant

You can even create web push notifications promoting these types of offerings to incentivize your web users to start using the mobile app.

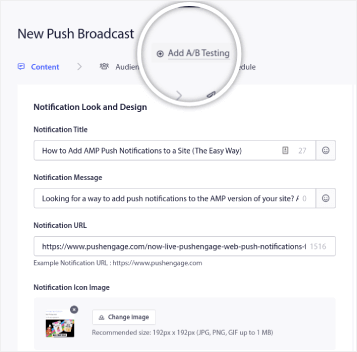

Use Our Smart Testing Suite to Track Your Goals

A/B testing can help you keep existing mobile app users engaged. Getting users to sign up for your app is one thing. But what you really want is to get them to become power users for the mobile apps.

Optimize everything that matters:

- Send time optimization → Reach users when they’re most responsive

- Message variation testing → Speak your customers’ language

- Action button placement → Increase conversion rates

- Rich media vs. text → Boost visual engagement

Promote Bank-Grade Security

You can build trust while driving engagement:

- End-to-end encryption → Protect sensitive financial data

- Custom authentication → Ensure secure user verification

- Deep linking → Direct access to relevant app sections

- Compliance automation → Stay within regulatory boundaries

Banks using our full automation suite see a drop in average cost-per-acquisition from $45 to under $1. But more importantly, they’re building lasting relationships with their mobile users through relevant, timely engagement.

Remember: Push notifications aren’t just about sending messages – they’re about creating meaningful mobile banking moments that drive real value for your customers.

2. Website-to-App Conversion Techniques

Here’s a shocking stat from our banking customers: 82% of website visitors who show interest in mobile banking never complete the app installation. They’re literally raising their hands saying “I’m interested,” but traditional download prompts fail them.

So, what can you do? Let’s take a look at a few ideas on how to promote mobile banking.

Using Banners and Popups

I’m not talking about those generic app store badges everyone ignores. You can set upt smart banners and popups that:

- Detect user device & OS → Show exact compatible app version

- Remember user preferences → No repeat prompts for dismissals

- Track user journey → Appear at high-intent moments

- Save browsing state → Continue user activity in-app

I’d recommend using OptinMonster to create these popups. If you’re just discovering what OptinMonster is, here’s the down-low…

OptinMonster has pretty much everything you need to start, grow, and scale your email lead generation process on your website. If that sounds like a stretch, it’s really not. That’s how they made their mark in the WordPress industry since launch.

When OptinMonster was first launched in 2013, there were no good lead generation toolkits in the market. Especially not for the WordPress industry and most definitely not one with so much automation. Many people believed that popups provided a horrible user experience and stayed away from them.

But OptinMonster changed that outlook forever.

To date, OptinMonster is one of the best WordPress marketing tools in the world. And it’s not just because of their creative campaigns. The functionality from the software suite you get can really make a difference in your business growth. I wrote a full review of OptinMonster, so feel free to check that out as well.

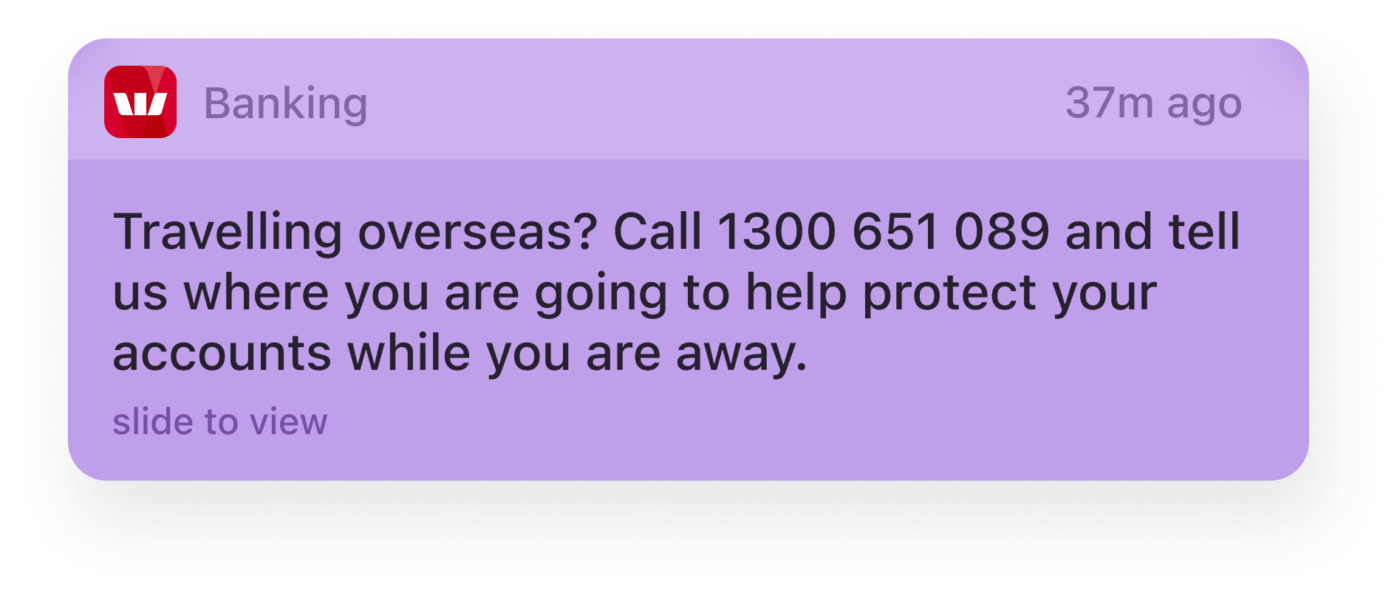

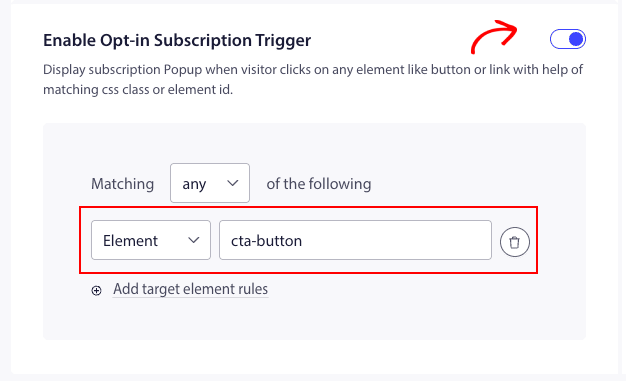

Use Contextual Triggers to Promote Your Mobile App

If you simply send someone an SMS asking them to use your mobile app, it’s very unlikely that they’ll sign up for it. You need to find more and more ways to incentivize your customers to download and start using your app.

One very cool way to do that is to use contextual triggers.

- Checking mortgage rates? → Show mortgage calculator inside your app. Just put up a QR code on your website.

- Viewing statements? → Highlight paperless banking in-app in your content.

- Multiple login attempts? → Demonstrate biometric login ease once they figure out how to regain access to the web account.

- Branch locator usage? → Show off how customers can find the nearest branch from the app using Google Maps.

And for the most part, these are simple to do. You can just set up the automation once and have it run forever!

Our banking clients see website-to-app conversion rates jump from 18% to 54% on average. More importantly, these users show 3x higher lifetime value because they start with clear purpose and direction.

Every website visitor is a potential mobile banking user. The key isn’t just asking them to download – it’s showing them exactly why their banking life will be better with your app.

3. In-App Engagement Strategies

90% of banks we work with have the same problem: fantastic app download numbers, but abysmal active user rates.

One regional bank had 200,000 downloads but only 8% of regular users. Within 60 days of implementing PushEngage’s engagement automation, they hit 47% of active users.

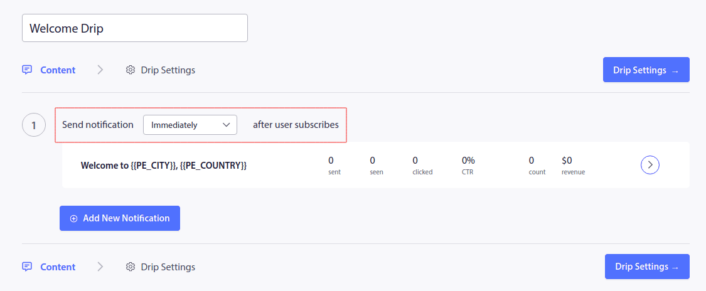

Smart Onboarding Automation

One of the most annoying things in any financial app is a poorly constructed onboarding flow. But if the onboarding is too long, that makes it even more frustrating. At the same time, you don’t want to sacrifice the scope of product education.

Here’s a nice trade-off: You can keep the app onboarding super short and then, set up an onboarding automation that takes care of product education.

- First login → Welcome series with feature spotlights

- Profile completion → Reward milestone celebrations

- Feature discovery → Personalized usage tips

- Security setup → Trust-building confirmations

A nice welcome campaign can change feature adoption rates and you can even use attributes and dynamic tags to keep track of which features are used most often.

Behavioral Achievement System

Just to follow up on the last idea, you can create a full gamification engine that drives feature adoption:

- First mobile deposit → Instant cash reward

- Bill pay setup → Fee-free month

- Budget tool activation → Personalized insights unlock

- Investment account funding → Expert consultation

The only tweak I’m suggesting here is to also take use behavior into account. One simple way to do that is to create behavioral segments.

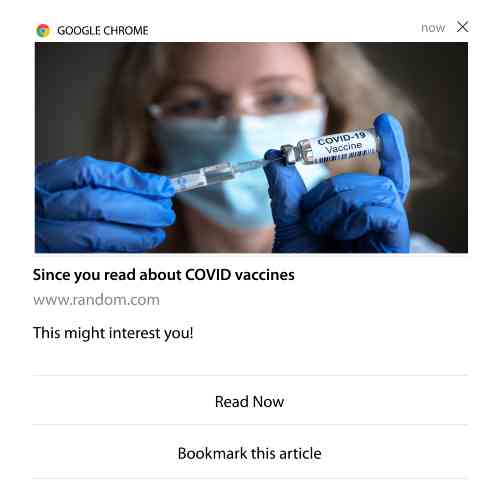

Dormancy Prevention

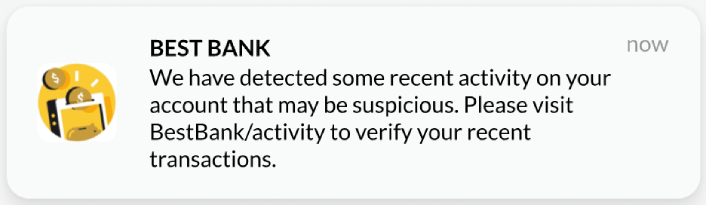

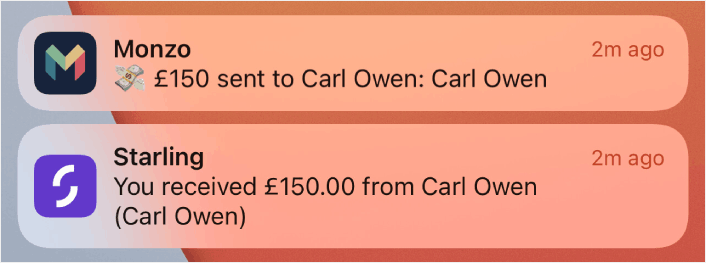

Push notifications can re-engage dormant users, promote new features, or drive time-sensitive actions. When used strategically, they significantly boost retention and conversion rates. One simple way to reactivate dormant users is to send transaction notifications like financial apps do:

But you can also spot and re-engage at-risk users using custom campaigns:

- Usage pattern analysis → Early warning system

- Engagement scoring → Automated re-activation campaigns

- Feature abandonment → Guided completion assistance

- Session drop-offs → Contextual re-engagement

The more you can identify customer triggers, the easier it is for you to build engagement.

The Truth About Mobile Banking Promotion Tools

Here’s what nobody in the push notification industry wants to admit: most platforms promising “banking solutions” are just generic notification tools with a banking label slapped on. Having processed over 1 billion banking notifications, I can tell you there’s a world of difference between basic push capabilities and true banking engagement tools.

Let’s cut through the marketing noise. Most push notification platforms offer:

- Basic notification delivery

- Simple segmentation

- Standard analytics

- Generic authentication

What banks actually need:

- SOC2 & ISO 27001 compliance

- Multi-factor authentication flows

- End-to-end encryption

- Flexible campaign types supported by robust infrastructure

At PushEngage, we built our banking suite after seeing financial institutions struggle with platforms that couldn’t handle their real requirements. The difference shows in the numbers:

Industry Average vs. PushEngage Banking Performance:

- Delivery rates: 76% vs. 99.9%

- Engagement rates: 12% vs. 42%

- Security incidents: Variable vs. Zero

- Setup time: 2-3 weeks vs. 48 hours

Before you invest in any push notification platform for your bank, ask these critical questions:

- Is it built specifically for financial services?

- Does it meet all banking security standards?

- Can it handle your transaction volume?

- Does it integrate with your core banking system?

Let’s look at what really matters when choosing a banking notification platform.

Which Push Notification Service Do You Choose?

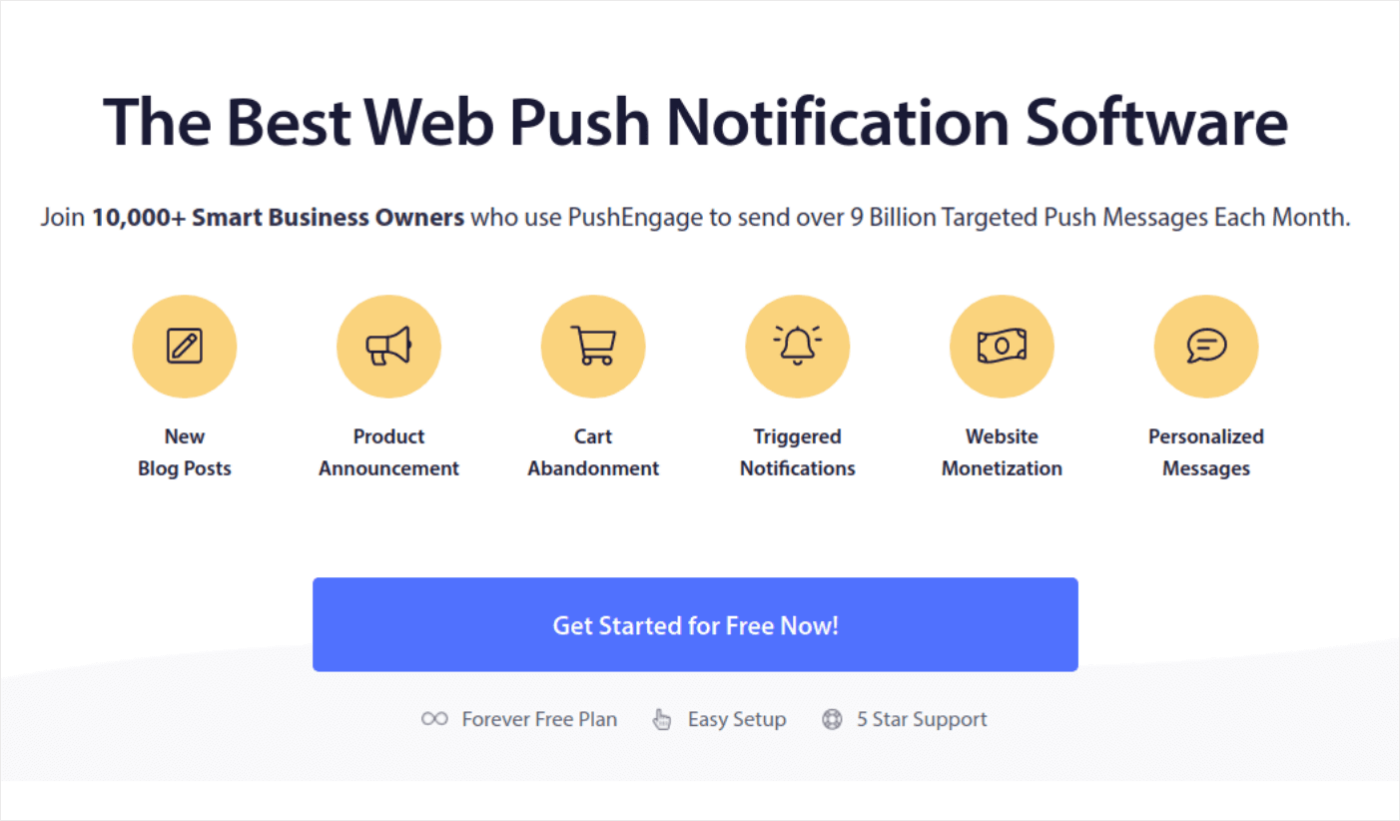

I recommend that you use PushEngage to get started with your push notification campaigns.

PushEngage is the best push notification software in the world.

And yes, PushEngage does have a free plan with limited features. The way in which PushEngage is priced allows you to get started for free, get some quick wins using basic push notification campaigns, and then use your profits to upgrade and unlock even more powerful campaigns and automation functionality.

Here’s what you can get from a paid plan:

- High-converting campaigns including Drip Autoresponders, Cart Abandonment Campaigns, Price Drop Alerts, and Inventory Alerts

- Higher subscriber limits so that you can keep growing your push notification subscriber lists seamlessly

- Higher sending limits so that you can send more push notifications across different campaigns as your business grows

- More ways to target campaigns, including Customer Timezone Sending, Custom Triggered Campaigns, and Personalized Smart Tags

- Goal tracking and advanced analytics to always keep improving the ROI on your push notifications

- Split testing to test your copy, images, or display rules to see which converts the best

- A Dedicated Success Manager to help you with Success Scripts, Behavior Automation, and Follow Up Campaigns

And these features are built to help small businesses grow.

But more importantly, here’s what makes PushEngage the perfect fit for banks:

- Regulatory compliance is built-in, not bolted-on

- Real-time transaction trigger capability

- Multi-language, multi-region support

- Custom security protocols

- Automated campaigns with powerful retargeting options

Take a look at our case studies, and you’ll know how all kinds of businesses have enjoyed a lot of success from PushEngage’s push notifications. You should also check out this ROI Calculator before making a decision.

How to Promote Mobile Banking Today

If you’re just starting to explore push notifications and thinking of how to promote mobile banking, you should get started with setting up campaigns.

PushEngage is the #1 web push notification software in the market. If you’re not sure where to start, you can sign up for the free version. If you’re looking to scale your business with powerful campaigns, though, you should go for one of the paid plans. Or, you can check out these amazing resources to get started:

- Why Mobile App Push Notifications Are Great for Your App

- Mobile App Engagement Strategy for New App Builders

- What App Engagement Metrics Should You Look At

- What Are Push Notifications? A Simple Guide for Epic Results

- Push Notification Cost: Is It Really Free? (Pricing Analysis)

That’s all for this one.